When buying a home in Kansas City, understanding the impact of your credit score on…

Boost Your Credit Score Before Buying a House

Buying a house involves careful consideration, and obtaining a mortgage can be a stressful part of the process. To make it smoother, it’s essential to take steps to boost your credit score. A higher credit score increases your chances of securing a mortgage at an affordable interest rate. Before making the decision to buy a house, it’s important to calculate what you can afford and then focus on improving your credit score. Here are six tips to help you enhance your credit score before applying for a mortgage.

Review Your Credit Report

Regularly checking your credit report is a simple task that can be done through services like annualcreditreport.com or your bank’s resources. Your credit report provides an overview of your bank accounts, loans, and credit cards from previous years. Take the time to review older accounts for accuracy. If you come across any unfamiliar entries, investigate them further and consider disputing them. Additionally, understanding your credit report helps you determine what actions to take to boost your credit score and gives you an idea of the available interest rates for your home loan.

Dispute Inaccuracies in Your Credit History

Once you’ve examined your credit report, make note of any inaccuracies you find. Resolving discrepancies in your credit history can be a challenging and stressful process, but it is crucial to rectify them. These errors can range from incorrect personal information to debts falsely marked as unpaid. Regardless of the nature of the error, it’s important to address it promptly. Typically, you’ll need to contact each credit bureau or service to correct the information. In cases where an unpaid debt is listed, you may need to contact the company claiming the debt and provide evidence of payment.

Maintain Consistent Credit Card Spending

Using credit cards wisely is crucial for improving your credit score. While it’s important to avoid excessive spending, it’s equally important to utilize your credit cards regularly. However, it’s crucial to keep your credit card spending low to maintain a healthy credit score. Maxing out your credit card consistently makes it much harder to improve your score. Aim for consistent spending each month and be prepared to pay off any increases in credit spending promptly.

Reduce Your Debt

While having some loans can contribute to building your credit history, paying off your debts can significantly boost your credit score. If you don’t have any outstanding debt, you’ll have a higher credit score and be eligible for better mortgage rates. Ensure that you make timely payments each month to gradually decrease your debts and improve your credit score. Whenever possible, consider paying more than the minimum payment to expedite the debt repayment process. Prioritize paying off high-interest debts first and understand the distinctions between consolidating and refinancing debt.

Make Payments on Time

To avoid late payments, consider setting up automatic payments through your bank, especially if you struggle to remember due dates. While paying off your credit card or loan debt in full each month is ideal, making on-time payments is crucial. However, for other recurring bills such as rent, electricity, or phone bills, it’s essential to pay them in full every month without incurring late fees.

Avoid Opening New Accounts

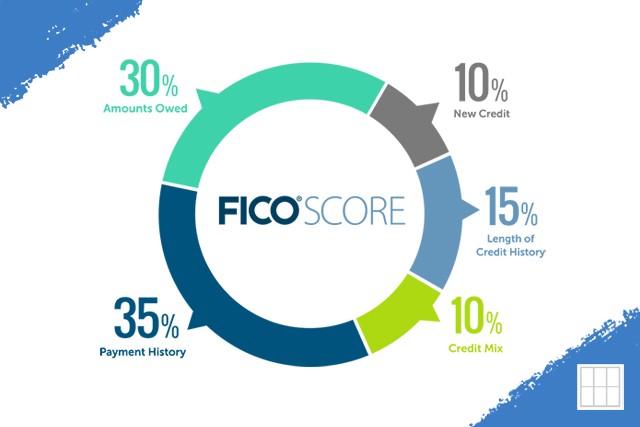

Having multiple accounts can be beneficial for your credit score, but opening new accounts can have a negative impact. A new credit card, for instance, can slightly lower your credit score. Remember that your credit score is influenced by the length of your credit history, and opening a new credit card shortens the average age of your accounts. Additionally, each new credit card application triggers a hard inquiry on your credit report, which leads to a slight decrease in your credit score. Furthermore, the availability of perks for spending on a new credit card may tempt you to increase your spending, which can negatively affect your credit score.